As long as a motorist doesn't enter an accident in much less than a year, they 'd be better off. low cost auto. The value of the vehicle, If a car isn't worth a lot, it may not pay to have coverage with a high insurance deductible. money. Say a driver chooses accident insurance coverage with a $1,000 deductible and also their automobile is just worth $1,000.

In this instance, the vehicle driver would certainly be better off abandoning accident insurance coverage completely (dui). How to stay clear of paying a car insurance deductible, The most effective way to prevent paying an automobile insurance coverage deductible is to stay clear of mishaps, theft, or damage. Method defensive driving, comply with the policies of the road, obey the rate restriction, and also avoid driving in bad weather.

cheapest auto insurance cheaper car laws

cheapest auto insurance cheaper car laws

People can also select a policy without any insurance deductible, albeit at a higher price (auto insurance). Or they can register for a vanishing or vanishing deductible with insurance firms that provide it. suvs. This will minimize the amount of the deductible by a collection quantity throughout each time period the vehicle driver is without accidents.

affordable insure auto insurance insure

affordable insure auto insurance insure

You'll additionally have to pick your insurance coverage deductible, which can be a lot more difficult than it sounds - credit score. To choose the ideal deductible for you, you'll require to consider your driving history, your emergency fund, and also the expenses of various deductibles, along with numerous other elements.

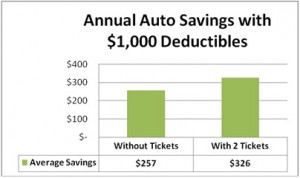

Key Takeaways Your deductible is the part of expenses you'll spend for a protected case (cheap auto insurance). Weigh your car's value, your emergency fund, as well as the costs of protection when picking a deductible - vehicle. Picking a greater deductible may aid you conserve cash on premiums, yet this indicates you'll have to pay even more expense after a mishap.

How Car Insurance Deductible: What Is It And What Will It Browse around this site End Up ... can Save You Time, Stress, and Money.

credit credit insured car car

credit credit insured car car

car cheap car credit cheaper cars

car cheap car credit cheaper cars

In some states, you might additionally have an insurance deductible for:: Pays to repair your auto after damages brought on by a vehicle driver without insurance or without enough coverage.: Pays your clinical bills when you have actually been harmed in an accident.: Covers the prices of some mechanical repair work, just like a service warranty.

Whether you pay a deductible after an event depends on your coverage, that is at mistake, your insurance policy business, and your state's laws - vehicle insurance. In California, you can qualify for a deductible waiver on your crash coverage, which implies your insurance company will certainly pay the deductible if a without insurance vehicle driver hits you.

Just how Does an Insurance deductible Work? Visualize a tree branch falls on your car and creates damage (affordable). You file an insurance claim on your extensive insurance coverage and the repair shop estimates it will certainly cost $1,000 to deal with. What you'll pay depends on your insurance deductible: $250 $250 $750 $500 $500 $500 $1,000 $1,000 $0 If the expense of repairing the damages coincides or virtually the like your deductible, you may select not to submit a case because you 'd shed any type of claim-free discount rate.

When Do You Pay a Deductible? In the scenario above, with a $500 insurance deductible, the insurance company would pay the car repair service shop $500, and also you 'd be anticipated to pay the other $500 (affordable).

As the automobile's value comes down, the chance of a complete loss goes upmeaning it might not be worth buying optional protections. The Kansas Insurance coverage Division recommends carrying only obligation coverage on autos worth less than $3,000.

Some Known Details About Do I Pay A Deductible If I Hit A Car? - Clearsurance

low-cost auto insurance cheapest car cheap insurance auto insurance

low-cost auto insurance cheapest car cheap insurance auto insurance

Various Other Questions to Ask When Selecting Deductibles While the three variables above are the most important when picking a deductible, you'll wish to ask these concerns, as well. Is There a Required Minimum Deductible? It depends on your insurance company as well as state. Many protection deductibles begin at $250 or $500, but some insurance firms supply a $0 deductible option for particular coverages, and also others may need higher-risk vehicle drivers to carry greater deductibles.

Can You Make Use Of Other Insurance Policy to Cover the Costs of Injuries? In some states, you might be able to make use of health coverage to pay the prices of injuries as a result of auto accidents rather of counting on vehicle insurance protection, such as clinical repayments or PIP insurance - perks. In this situation, you could choose a higher insurance deductible or a lower limitation on those protections, which would conserve you money - cheap car insurance.

If your automobile is currently at the repair store, you could get a finance to pay the insurance deductible or ask the store to hold your lorry until you can find some money. What Is the Highest Possible Insurance Deductible for Cars And Truck Insurance Coverage? The greatest insurance deductible offered to you relies on your state and also your insurer, but Mc, Bride-to-be claimed an average high deductible is around $1,000 (liability).

For specialty vehicles or antiques, they can get to $5,000 to $10,000. What Is the Ordinary Deductible for Automobile Insurance? No national standard across states and also insurance firms has actually been published, yet Progressive states $500 is one of the most common deductible picked by its insurance holders.

If you have actually already experienced an insurance claim, you've most likely discovered how your deductible works very first hand (cars). For those who have not, it can cause confusion about simply what an insurance deductible is and also who spends for it. What an insurance deductible is A deductible is the quantity of cash you (the called insured on the policy) pays out of pocket for the price of damages before the insurer pays - risks.