How auto insurance policy prices are set, There are several key aspects that are used by the insurance provider to identify just how much you will spend for car insurance policy (cheap car). These factors consist of: Your age, The state you stay in, Your driving record, Your credit rating, The sort of car you have, Your marital condition, Generally, drivers under the age of 25 pay much greater premiums than those who have actually reached this age - cheap car.

Here is a breakdown of the ordinary cost of automobile insurance coverage by age: New and also teen motorists, Both more youthful as well as older vehicle drivers are statistically far more most likely to have a mishap than middle-aged chauffeurs, however the mishap rate for teens is much greater than that for older chauffeurs. cheaper cars. This is largely why automobile insurance is so expensive for teenagers, as well as why having a teen included to a parent's plan can assist minimize the price - car insured.

By themselves policy, prices are commonly the greatest for 17- as well as 18-year-old drivers. Drivers in between 20 24During this period, many chauffeurs will see peak expenses progressively start to decrease as they near age 25. While rates are likely reduced than those seen in the teen years, the expense is still significant, especially at a time when drivers might additionally be dealing with independent living expenses or college tuition.

Drivers in between 25 55Drivers in this group remain in the "pleasant spot" for insurers due to the fact that they have accumulated driving experience and also generally resolve in the reduced threat category of life conditions. Vehicle insurancerates for those in this age array are normally reduced than they are for any type of other age range.

Excitement About How Much Will Your Auto Insurance Premium Decrease After 25

auto credit business insurance auto

auto credit business insurance auto

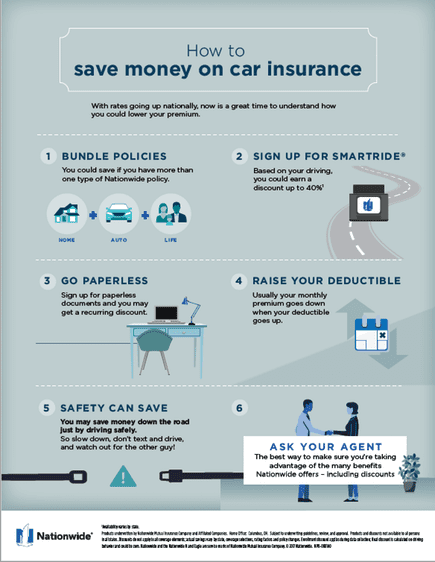

Just how to decrease the influence old on your cars and truck insurance coverage prices, If you are still a teenager or under the age of 25, there are a number of things that you can do to reduce the expense of vehicle insurance. auto. Below are a few that can have a significant effect on the expense of auto insurance for young drivers: Several insurance firms will provide a discount rate to trainees that maintain a specific grade factor standard, such as B or B+ (cheap).

Finishing the program typically causes a wonderful price cut that differs by provider providing the program. Assists establish rates based on driving actions and also linked danger. If you or your family insures multiple vehicles under one company, you may see added cost savings. This is especially practical if the driver can pay for insurance policy for 6 months at a time.

Particularly suitable to college-aged chauffeurs. Various other methods to minimize vehicle insurance policy, There are likewise a number of various other points you can do to conserve money on your cars and truck insurance costs that do not rely on your age. A few of these actions consist of: Lowering or dropping your collision coverage and bring only liability insurance policy if you have an older car. cheapest car.

There are a variety of various actions that you can require to lower your car insurance coverage expenditures when you are younger (cars). Other things can be done to minimize your auto insurance no matter of your age. Car insurance coverage is typically the most expensive when you're young, but thankfully, time and also experience generally decreases rates (cheaper car).

What Affects Car Insurance Premiums - State Farm® - The Facts

Consult your economic expert or insurance representative to learn more on car insurance coverage as well as what you can do to decrease your rates (cheap car insurance).

Generally, cars and truck insurance policy decreases at age 25 by approximately 20% as the claims threat linked with that age is statistically lower. This isn't a difficult rule. New vehicle drivers and also motorists with infractions on their records still pay greater costs, regardless if they're 25 or older.

Merge your vehicle policy with your house insurance coverage - insurance. The majority of insurance coverage business provide a discount rate for packing multiple plans.

insured car cars vehicle insurance vehicle insurance

insured car cars vehicle insurance vehicle insurance

Worldwide of cars and truck insurance coverage, there are a lots of variables that automobile insurance firms use to evaluate the danger of insuring a provided chauffeur and their car - insure. This can be something as standard as your age or something much more certain like your vehicle's make and also version depending on the insurance providers. low cost.

5 Reasons read more Your Car Insurance Rate Changes - Liberty Mutual for Dummies

Cleaner records are verified to result in reduced premiums. This leaves vehicle insurance policy business with no other alternative yet to think that their danger is greater than the typical vehicle driver.

Prices of repair work as well as mechanical components are thought about by insurance companies, in addition to the safety function score (auto insurance). Ask on your own how much you spent on your automobile and how safe it is; those may be type in identifying your vehicle insurance costs rates. While some states do not base their auto insurance costs prices on sex or gender, most of them do.

Because of this, ladies generally pay lower vehicle insurance coverage costs with a lot of insurance companies. As the highlight of this blog post, age is a significant variable in figuring out auto insurance costs rates. risks.

These vehicle drivers, age 25 and also more youthful, are drivers with the highest possible cars and truck insurance premiums out of anyone. This piece concentrates on just how much cars and truck insurance costs prices will certainly go down by the time the chauffeur transforms 25. The outcomes may surprise you. You have a credit history for your cars and truck insurance premium which is based upon how likely you are to submit a claim.

9 Major Factors That Affect The Cost Of Car Insurance Fundamentals Explained

Some states do look at typical debt card ratings, so it assists to constantly pay your costs on time as you do with your auto insurance policy costs. Why Are Auto Insurance Policy Costs so High For Teens and also Drivers Under 25? It's common that when a teen prepares for their driving certification examination, their parents get ready for a walking in vehicle insurance coverage premium rates. auto.